Bitcoin Mining Profitability Rose 2% in July Amid BTC Price Rally, Jefferies Says

A rising bitcoin price is seen as most favorable for Galaxy’s digital assets business, while miners fight a rising network hashrate, the report said.

- Bitcoin mining profitability increased in July as the world’s largest cryptocurrency outperformed the rise in the network hashrate, the report said.

- The bank said U.S.-listed miners accounted for 26% of the total network compared to 25% in June.

- Jefferies noted that IREN mined the most bitcoin in July, followed by MARA.

Bitcoin investment bank Jefferies said in a research note on Friday that mining profitability grew 2% in July as the price of the world’s largest cryptocurrency rose 7% while the network hash rate jumped 5%.

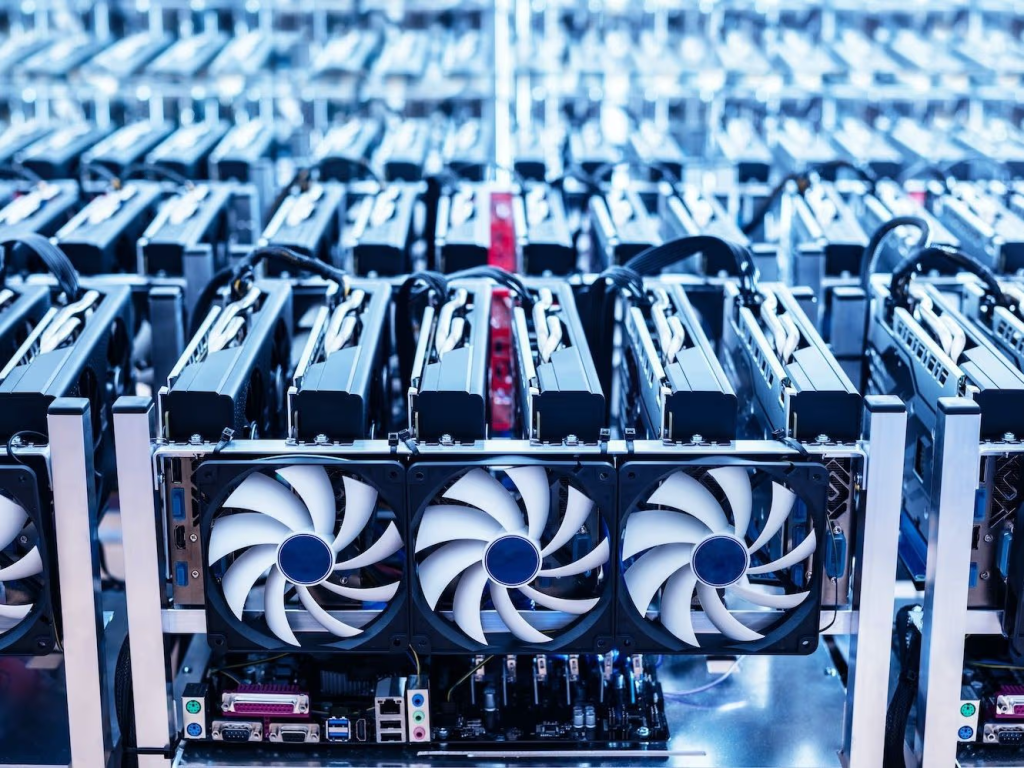

The hashrate refers to the total combined computational power used to mine and process transactions on a proof-of-work blockchain, and is a proxy for competition in the industry and mining difficulty. It is measured in exahashes per second (EH/s).

U.S.-listed mining companies mined 3,622 bitcoin in July, versus 3,379 coins the month before, the report said, and these firms accounted for 26% of the total network compared to 25% in June.

IREN (IREN) mined the most bitcoin, with 728 tokens, followed by MARA Holdings (MARA) with 703 BTC, the bank noted.

Jefferies said MARA’s energized hashrate remains the largest of the sector, at 58.9 EH/s at the end of July, with CleanSpark (CLSK) second with 50 EH/s.

Assuming the hashrate of BTC miners is 1 EH per second, the daily revenue in July was approximately $57,000, compared to approximately $56,000 in June and approximately $50,000 in the same period last year.